A Message to Our Investors

Thank you for your continued confidence in Capital Direct I Income Trust. We value your trust and remain committed to managing your investment with care, professionalism, and discipline.

In this update, we're pleased to share our Q3 performance, insights on the Bank of Canada policy rates, the Toronto condo market as well as our community impact.

*If you can't see the images, please try downloading them in your email browser.

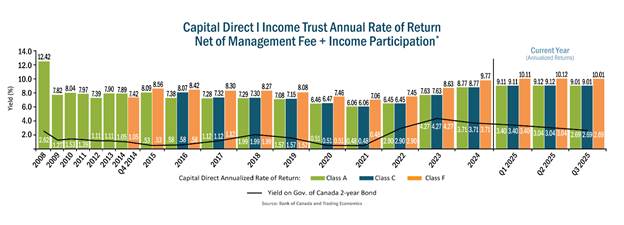

Q3 Returns: Strong Yield and Growing AUM

We're pleased to report our returns for Q3 2025:

- Class A &C Units: 9.01%* (1)

These results reflect our consistent focus on quality lending, real estate-backed security and risk-managed portfolio construction.

Fund Fact Sheets ' Q3 2025

- Download our Class A Fund Fact Sheet

- Download our Class C Fund Fact Sheet

- Download our Class F Fund Fact Sheet

📊 View Our Updated Performance Chart

These results

reflect our continued focus on stability and consistent income in a

rate-sensitive environment.

(1) Annualized return is based upon Q3 2025 net income produced by Class A, C and F Units of the Trust after any discretionary reduction by Management in Income Participation or distribution. Annual return is based on net income produced by the net assets of the Trust in that year after any discretionary reduction in Management fees or Income Participation. (2) Class F Units must be purchased through a third-party dealer and are intended for fully managed accounts.

All investments carry risks and past performance is not an indication of future returns. All subscriptions for the purchase of units must be made pursuant to available prospectus exemptions. Investors should read the current offering memorandum, especially the risk factors relating to a purchase of Units of the Trust prior to making an investment decision.

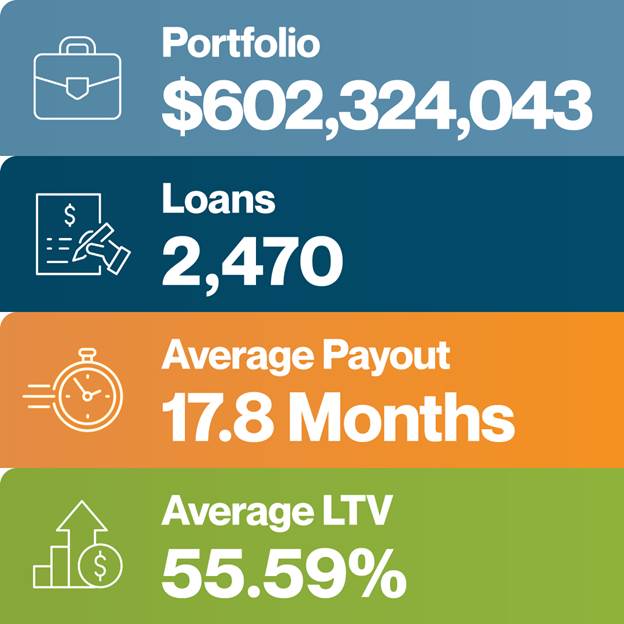

Fund Details*

*September 30, 2025

Bank of Canada Cuts Policy Rate to 2.25%

On October 29, 2025, the Bank of Canada announced that they had lowered the policy rate to 2.25%. As a result, the Royal Bank of Canada (RBC) has decreased its prime rate similarly by 25 basis points down to 4.45% on October 30, 2025. '

With a lower rate, we might expect to see an uptick in the housing market in the next year. This follows a similar trend that we saw for Canadian Home Sales in August this year. The Canadian Real Estate Association (CREA) reported the best August for sales since 2021.

''

''

Source: https://www.bankofcanada.ca/2025/10/fad-press-release-2025-1...

Toronto's Condo Market

Toronto's condo market remains a concern for Ontario real estate investors. In October 2025, GTA home sales fell 9.5% year over year, while condo prices eased 4.7% to about $660,208 according to the Toronto Regional Real Estate Board (TREREB).

Although condo sales are down, it doesn't mean that the entire market is at a standstill. With more purchasing power, prospective buyers, 'have gone out of the city core in order to purchase larger properties or more single family homes,' says Shawn Zigelstein, a mortgage broker at Royal LePage.

So what does this mean for our investors?

Our portfolio in Ontario, and across the country, is well diversified to mitigate risk. In fact, condos in the GTA make up only around 15% of our total asset value in Ontario. The rest is spread across various dwelling sizes in all corners of the province. While there may be uncertainty on the condo market itself, investors in Capital Direct I Income Trust can be assured that our portfolio was designed to offset risk during any real estate trend.

In the Community

$3.2+ Million Raised for BC Health Care at the Capital Direct Vitality Gala

Thank you to everyone who joined us last Saturday, November 1, for the VGH+ Capital Direct Vitality Gala 2025. 'No breakthrough happens alone' was the perfect phrase to describe the generosity of all those who attended, as we raised over $3.2 million for healthcare innovation in BC. We were happy to host everyone at the Vancouver Convention Centre and celebrate a wonderful a night of community and Connections, this year's Gala theme.

Share Your Thoughts & Questions!

Your feedback helps shape our future reports. If you have questions about anything we've covered, or topics you'd like us to explore next quarter, please let us know!

We're committed to addressing your suggestions and will highlight answers in our next update. Your input is important, please reach out any time to [email protected] 'and help us make these reports even more valuable for you.